The Basic Principles Of Paul B Insurance

Wiki Article

The Ultimate Guide To Paul B Insurance

Let's suppose you pass away an unforeseen fatality at a time when you still have numerous turning points to accomplish like youngsters's education and learning, their marriage, a retired life corpus for your partner etc. Likewise there is a financial debt as a housing financing. Your unforeseen death can put your family members in a hand to mouth scenario.

Despite just how difficult you attempt to make your life much better, an unanticipated occasion can entirely transform points inverted, leaving you physically, mentally and also financially strained. Having sufficient insurance assists in the sense that a minimum of you don't have to consider cash throughout such a difficult time, and also can focus on recuperation.

:max_bytes(150000):strip_icc()/insurance-policies-everyone-should-have.asp-final-cf42cc8f61ae46a7acffc9b519457815.png)

Such treatments at excellent medical facilities can set you back lakhs. Having health insurance in this case, saves you the concerns and stress of arranging money. With insurance in position, any financial stress and anxiety will certainly be taken treatment of, and also you can focus on your recovery. Having insurance policy life, health and wellness, as well as responsibility is a crucial part of monetary preparation.

Unknown Facts About Paul B Insurance

With Insurance policy compensating a huge component of the losses companies and also households can bounce back rather conveniently. Insurance business merge a large quantity of cash.

Insurance policy is often a long-lasting agreement, specifically life insurance. Paul B Insurance. Life insurance policy intends can proceed for more than three years. Within this moment they will accumulate a large quantity of wealth, which returns to the financier if they endure. Otherwise, the wealth mosts likely to their household. Insurance policy is a necessary economic device that helps in handling the unforeseen costs efficiently without much problem.

There are extensively 2 kinds of insurance as well as allow us comprehend just how either is relevant to you: Like any type of accountable person, you would have prepared for a comfy life basis your earnings and also career estimate. You and your family members will be desiring for standard things such as a good home and also quality education and learning for youngsters.

The smart Trick of Paul B Insurance That Nobody is Discussing

Kid insurance coverage plans like ULIP and also cost savings strategies get a financial investment worth with time. They also give a life cover to the insured. These strategies are excellent to purchase your child's college and also marital relationship objectives. Term life insurance is the pure type of life insurance policy. Term life cover just provides a death benefit for a restricted duration.

If you have a long time to retire, a deferred annuity gives you time to invest throughout the years and construct a corpus. You will certainly obtain revenue streams called "annuities" till completion of your life. Non-life insurance policy is additionally described as basic insurance coverage as well as covers any type of insurance coverage that is outside the province of life insurance policy.

informative post

In the instance of non-life insurance coverage, aspects such as the age of the asset and also insurance deductible will also affect your choice of insurance plan. Permanently insurance strategies, your age as well as health will impact the premium expense of the strategy. If you possess an automobile, third-party insurance coverage is compulsory prior to you can drive it when driving.

Paul B Insurance - Truths

Please note: This post is released in the public interest and also indicated for general info functions just. Readers are encouraged to exercise their caution and not to rely on the components of the article as definitive in nature. Viewers must research more or seek advice from an expert hereof.

Insurance policy is a lawful contract in between an insurance firm (insurance provider) as well as an individual (insured). In this instance, the insurance provider assures to make up the guaranteed for any losses sustained as a result of the protected contingency happening. The contingency is the incident that leads to a loss. It could be the insurance policy holder's fatality or the home being harmed or destroyed.

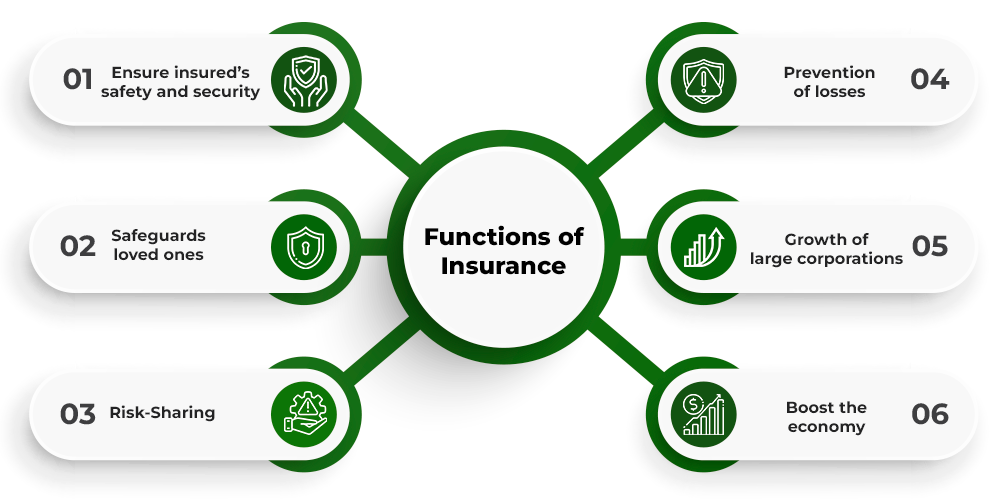

The key functions of Insurance coverage are: The vital function of insurance policy is to guard against the possibility of loss. The moment and also amount of loss are unforeseeable, as well as if a risk occurs, the person will sustain a loss if they do not have insurance. Insurance coverage guarantees that a loss will be paid as well as thereby shields the insured from experiencing.

More About Paul B Insurance

The procedure of figuring out costs rates is additionally based on the plan's risks. Insurance coverage offers settlement assurance in the occasion of a loss. Better planning as well as administration can assist to minimize the risk of loss (Paul B Insurance).

great siteThere are a number of additional features of Insurance policy. These are as adheres to: When you have insurance coverage, you have ensured money to spend for the therapy as you get appropriate economic help. This is among the key additional functions of insurance where the public is safeguarded from ailments or mishaps.

The feature of insurance is to eliminate the stress and anxiety and also anguish related to fatality as well as residential property devastation. A person can devote their heart and soul to far better achievement in life. Insurance supplies a motivation to strive to far better individuals by guarding society versus massive losses of damages, damage, as well as death.

The Facts About Paul B Insurance Uncovered

There are a number of roles and importance of insurance coverage. Some of these have actually been offered listed below: Insurance coverage cash is invested in many efforts like water, power, and also freeways, contributing to the country's total financial success. Instead of concentrating on a solitary individual or organisation, the threat impacts numerous individuals and also organisations.

It urges risk control activity due to the fact that it is based upon a risk transfer device. Insurance plan can be utilized as collateral for credit rating. When it pertains to a residence funding, having insurance protection can make obtaining the car loan from the lending institution much easier. Paying tax obligations is one of the major duties of all people.

25,000 Section 80D Individuals and their family members plus moms and dads (Age less than 60 years) Overall Up to Rs. 50,000 (25,000+ 25,000) Area 80D Individuals and their family plus moms and dads (Age greater than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Area 80D People as well as their family(Anybody above 60 years of age) plus moms and dads (Age even more than 60 years) Amount to Rs.

Paul B Insurance Can Be Fun For Anyone

All kinds of life insurance policy plans are readily available for tax obligation exception under the Earnings Tax Act. The advantage is obtained on the life insurance coverage plan, whole life insurance policy plans, endowment plans, money-back policies, term insurance policy, and also System Linked Insurance Coverage Plans. The optimum reduction available will certainly be Rs. 1,50,000. The exception is offered the premium paid on the plans taken for self, partner, dependent children, and also dependent moms and dads.

This provision likewise permits an optimum reduction of 1. 5 lakhs. Every individual must take insurance policy for their wellness. You can pick from the different sorts of insurance policy based on your need. It is recommended to have a health and wellness or life insurance policy policy since they verify useful in tough times.

Insurance policy helps with moving of danger of loss from the guaranteed to the insurance firm. The fundamental principle of insurance policy is to spread risk among a big number of individuals.

Report this wiki page